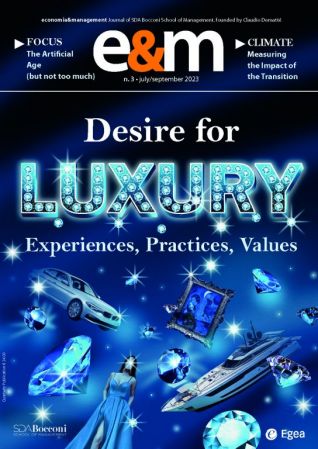

E&M

2023/3

Jewelry between Continuity and Transformation

Jewelry is one of the fastest growing categories of the luxury sector (+23-25% sales increase in 2022 vs. 2021), receiving more and more attention and investments from large luxury groups and private investors. At the same time, it remains a sector where lines move slowly and life cycles are relatively long. This brings interesting paradoxes, the five most of which are explored below in this article.