E&M

2023/4

The Great Challenges for Italian Industry

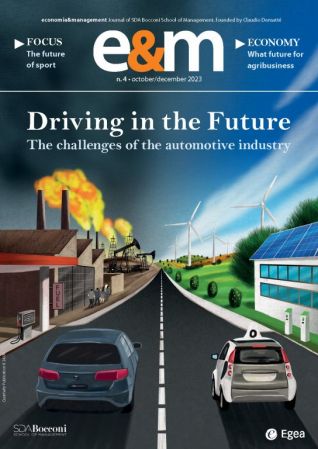

The automotive industry represents one of the pillars of the Italian economy. However, starting from 2000, the crisis of the FIAT production model, culminating in the merger between FCA and PSA, has led to a significant contraction in production and, consequently, in turnover. Italy remains an important player but risks lagging behind, threatened by the competition from other European countries. There is a need for structural reforms to address persistent issues, investments in R&D and workforce training, diversification of production, and a revival of the local public transportation industry.