E&M

2022/3

How to Extract Value from Governance

A survey conducted by SDA Bocconi has shed light on the fact that Italian companies that have adopted more advanced governance models have “stayed on course” better, obtaining superior performance in the period of the pandemic and being able to more correctly assess the risks deriving from internationalization, investing more in safer countries.

Italian companies that have adopted more advanced governance models have “stayed on course” better, obtaining superior performance in the period of the pandemic and being able to more correctly assess the risks deriving from internationalization, investing more in safer countries.

This was found by the “Report 2022” of the Corporate Governance Lab of SDA Bocconi, that considering the two-year period 2018-2020, analyzed all 5,398 Italian companies with turnover above 50 million euros, monitoring their governance and ownership structures.

For each company, the corporate governance index (CGI) was calculated based on five parameters. All of the parameters moved in a positive direction: diversity increased in 229 companies, a BoD was introduced and opened to outside board members in 79 and 182 cases, respectively. The positions of president and managing director were separated in 377 companies, and 251 shifted to individual leadership. There were 771 companies with an increasing CGI, 14 percent of the total (Figure 1).

The study showed that the companies with better governance achieved better performance: those that saw growth in CGI had less reduction in turnover (with a difference of 2.3 percentage points), a higher average ROA (+0.7), and fewer losses (-3).

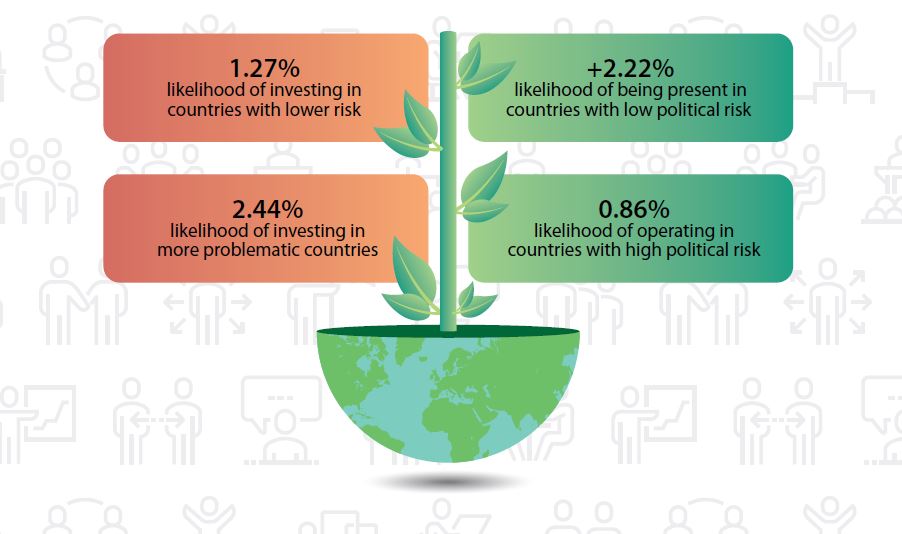

In addition, the companies with better governance succeeded in better assessing political, climate, and credit risks linked to internationalization. The correlation between exposure to risk and CGI demonstrates that the companies with a higher CGI are 2.22 percent more likely to be present in countries with low political risk, but only 0.86 percent more likely to operate in countries with high political risk, while those with a lower CGI see opposite results: they are 1.27 percent more likely to invest in lower-risk countries, against a probability almost twice as high (2.44 percent) to be in more problematic countries (Figure 2).

Figure 1 – The 5 parameters of the corporate governance index

Figure 2 – Assessment of risks

For a broader view of the centrality of growth governance models we refer you to the E&M Podcast hosted by Daniela Montemerlo, Affiliate Professor of Strategy and Entrepreneurship.