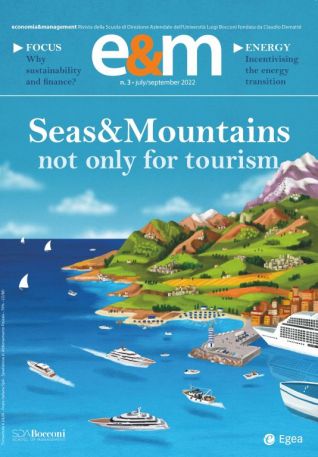

E&M

2022/3

New Trends in Beach Tourism

Beach tourism has always represented an important segment for Italy, and during the pandemic the seaside confirmed its position as the preferred tourist product for summer vacation. However, the changed socio-economic context has introduced some alterations in consumer behavior, such as attention to environmental sustainability and a broader sociality. These are changes that demand a rethinking of the traditional model of tourism.

Beach tourism has always represented an important segment for Italy, and during the pandemic the seaside confirmed its position as the preferred tourist product for summer vacation. However, the changed socio-economic context has introduced some alterations in consumer behavior, such as attention to environmental sustainability and a broader sociality. These are changes that demand a rethinking of the traditional model of tourism.

Although there are differences between nations, Europeans love seaside vacations: 60 percent of them choose this kind of vacation (compared to 43 percent of Americans and 68 percent of Chinese), often in combination with other tourist products. Both families and Gen Z prefer the beach, usually with long stays (4-9 nights), spending between 500 and 1,500 euros per person.[1] Moreover, tourism on European coasts is increasingly international[2] (45 percent of arrivals come from other countries, both inside and outside of the EU), to the point that the industry linked to coastal and beach tourism now generates approximately 183 billion euros in gross value added and gives work to over 3.2 million people between the Mediterranean, the Atlantic Coast, the Black Sea, and the Canaries.[3]

Going more into detail regarding our country, if we return to the pre-pandemic period, in 2019 Italian beach tourism recorded 109 million domestic visitors and 80 million foreign visitors, for overall spending of almost 21 billion euros,[4] equal to 43 percent of overnight stays in our country.[5] The sea as a product was therefore particularly attractive, not only for Italians – as we have always known – but also for visitors from abroad, ranking as the second highest spending segment, behind only cultural visits to the major art cities.[6]

It is among foreigners where strong and constant growth was recorded in the last pre-Covid years: +75 percent of arrivals between 2016 and 2019[7] and +137 percent spending between 2017 and 2019,[8] demonstrating not only growing attractiveness, but also an increase of the average stay, with a consequent increase of spending, meaning revenue for our tourism operators.

New consumer behavior

Two years after the outbreak of the pandemic, we can say that some trends have remained, while new consumer behavior has emerged. In 2021, when trips to Italy were at levels similar to 2020, but still far from pre-Covid levels, seaside vacations continued to be preferred by Italian, both inside the country (57.7 percent of total trips), and abroad (61 percent).[9] The growing rate of immunization and simultaneous reduction of infections and restrictions contributed to greater serenity in the population, feeding the desire to return to using open spaces for convivial events. This is where the beach resumed its role as the key destination for relaxation, a sort of “release valve” for the negative thoughts and deprivations that had characterized the winter.

Of those who took a beach vacation in 2020, 46 percent chose the same destination for 2021 as well,[10] confirming the trend towards proximity tourism, despite an initial return of foreigners. Due also to some continuing limitations on travel, according to Coldiretti/Istituto Ixè[11] 4 million international tourists were still missing. Among those who did come to the Italian coasts, a significant portion came independently by car, making Germany, France, Austria, and Switzerland the principle sources of foreign demand, and favoring the shores of Northern Italy (69.8 percent of Italians also traveled by car[12]).

The percentage of day-trippers was still significant, who from interior areas decided to go to the beach during the day. Their impact on mobility – access, traffic, parking – was considerable for Italian seaside destinations, but their contribution to the local tourism economy was often limited to only expenses for beach chairs and umbrellas, or lunch at a bar or restaurant. This, during a season that was still difficult from an economic standpoint: while Fipe-Confcommercio estimated lower revenues for bars and restaurants (-2 billion euros compared to 2019), we also need to note that competition among operators and territories was even stronger due to the economic difficulties resulting from the long lockdown periods.[13]

Some operators have found themselves having to manage accommodations held over from 2020 (many guests had not cancelled, but just postponed their trips), de facto going into the season with limited availability; others, especially in the South and the Islands, had limited demand due to restrictions on accessibility (we need to remember that during the pandemic many airlines, as well as rental car companies, reduced their fleets in order to recover liquidity, with consequent limits on production at the peak moments of summer requests).

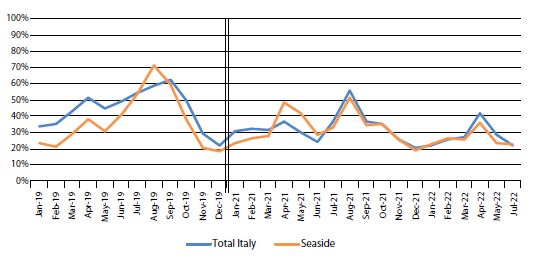

Returning to the numbers, the reading of the OTA saturation,[14] an increasingly important indicator both for the sales policies of hotel operators, and for destinations to monitor the pulse of the situation in real time (with official statistics often available only at the end of the season), offers positive signs for the beach sector, despite the difficulties. Last year, in fact, the beach sector positive influenced overall tourism trends in Italy (and continues to do so at the beginning of 2022).[15]

As mentioned, and as we will see further below, much more than in the pre-Covid period, there is a strong desire for relaxation, open spaces, and escape. This has directed many more travellers towards Italian shores, effectively lengthening the season as well compared to 2019, when short breaks, starting with long weekends in the spring, were often spent in art cities (Figure 1). And while in absolute terms a lower saturation rate could suggest lower volumes, we must not forget that the proximity tourist often travels without intermediation by an agency.

Figure 1 – Saturation of availability of accommodation facilities on OTA channels (percentages for 2019, 2021 and 2022)

Source: ENIT research office on data from The Data Appeal Company.

We must not forget that at the seaside as well, in 2020 there was a true boom in rooms/apartments for rent, and more in general of all forms of independent accommodations (campers, camping, glamping, mobile homes, boats, villas, etc.). And 2021 closed with only a partial reversal of the trend: private accommodations were confirmed as the predominant system (57.9 percent), even though hotels recorded an increase in long leisure stays (4 nights or more) equal to +48.5 percent over 2020.[16]

The drivers of choices in the purchase phase

The long-term effects of the pandemic, that have conditioned the choices made by travelers, have certainly introduced new needs and accelerated existing trends. As stated, with reference to reservations, in addition to being made just before departing, there are three key factors of choice in the purchase phase: price, safety, and flexibility of cancellation policies. While guaranteeing guests the possibility of free cancellation right before the trip convinced 73 percent of Italians to make purchases,[17] it is undeniable that the issue of safety in the post-Covid era has taken on another dimension.

Health safety had already been a driver of choices for years. Yet while beforehand tourists, especially Gen X and Boomers, sought out seaside locales able to guarantee rapid and adequate healthcare if needed, in the last two years cleaning and sanitization of the environments, especially indoors (accommodations and restaurants), have taken on an entirely different dimension.

Another new element in the post-Covid area, with respect to the classic stationary beach vacation for relaxation, have been what are called “beach itinerants,”[18] i.e. all of those tourists who, due in part to fears or limitations regards trips abroad, have chosen a beach area and spend multiple nights there, but alternating among different locales on the coast. They seek to combine multiple experiences, linked to the beach in a classic sense, but increasingly also to cultural and food and wine options.

Among those who decide to stay in the same destination for the entire period of their vacation, there has also been an increase in the number who decide to combine different activities and experiences: walks and hikes along paths and pedestrian routes, slow bike rides on bike paths, boat outings to discover the coast, excursions inland, and also local events, increasingly experienced as carefree moments for aggregation.

Although, as already mentioned, the lockdown certainly led to a greater desire for escape, contact with nature and open-air activities (sought by 47 percent of travelers in the post-Covid period), vacations have also been the way to recover both physical and mental well-being (79 percent) and to appreciate simple pleasures and gestures more (66 percent).[19] So in the last year we have a seen a revival of classic seaside destinations, places where people passed memorable vacations during their youth, in the search for happiness that recalls times past and nostalgia.

However, this does not mean that travelers have returned to the concept of the beach vacation from the 1970s and 80s. To the contrary, as we have seen, in addition to a search for experientiality at all levels, Italians do not want to give up on comfort. So we see that the services offered by seaside locales have become increasingly important in their choices. These are the places where people spend most of their time while on vacation, so tourists do not want to be without bars and restaurants, areas for relaxation, wellness, families with children, accessibility, and services on the beach and in the water, as well as entertainment. It is this concept of increasing the services available on beaches, as well as liberalization at the European level – as has taken place in other sectors – that was the focus of the “Bolkestein Directive,” to put beach concessions up for auction, which has provoked considerable political debate.

Between sociality and sustainability

The percentages vary depending on the surveys carried out (Airbnb, American Express, Booking.com, WTTC), but another aspect of bygone vacations has been revived: sociality. The vast majority of tourists have seen travel as a time to spend with friends and families, who due to the pandemic, they had not seen as much in the past two years. Thus the groups involved in visits changed: there are increasingly vacations with friends among young people, and multigenerational trips in families, in which grandparents, parents, and children spend time together, sometimes even with some aunts and uncles and cousins. The fact that people travel together does not, however, mean that they don’t need personal space. To the contrary, as the group grows, it is necessary on the one hand to guarantee comfort and functionality (communicating rooms, more bathrooms, bigger wardrobes, etc.) and on the other to seek to understand and satisfy the desires of all the members of the group also in terms of activities and experiences.

The pandemic has brought with it also a sense of renewed sensitivity towards environmental themes, the reduction of waste, and more in general, of sustainability, including from a social standpoint.[20] And beach vacations are no exception. While 83 percent of international travelers consider the sustainability of tourist models a priority for the future,[21] according to the survey carried out by Fondazione UniVerde in 2020, in planning their vacations 56 percent of Italians have considered the issue of how their choices could damage the environment, being willing to spend up to 20 percent more for this purpose.

This, while considering that for 34 percent of the population, travel will be the top non-essential spending item in their budget for the immediate future, even before entertainment, renovation projects, and expenses for luxury goods.[22] While the pre-pandemic yearning for vacations represented a desire, it has now been transformed into an actual need, to the point of being able to speak of “wander-must,” with a consequent positive effect also on willingness to pay.

So, looking at the future of beach vacations, the numbers, trends, and also the on the book for 2022 show encouraging signs. The OTA saturation for the coming months provides a comparison with direct competitors, such as Greece and Spain, on similar levels (practically always higher or equal to Greece and higher than Spain for the entire second half of the year), with an advantage in competitiveness during the entire year as regards prices.[23]

Improving the traditional tourist model

That said, the last two years have demonstrated that an exogenous event can rapidly demolish certainties and habits. So no room can be left for improvisation, if we want to remain competitive in the long term. The analysis of the data made available by new technologies today, but also the study of new solutions to better respond to demand, can transform into opportunity even situations of uncertainty like the one we are experiencing and provide a new impulse for the tourist development of maritime areas.

The post-pandemic period can and must be seen as an opportunity to rethink the traditional tourist model, where it can be improved; especially in contexts such as seaside destinations, where for years mass tourism has represented, and in some cases unfortunately continues to represent, the dominant model. Rethinking the tourist offer in a phase of acceleration of a process already underway means addressing considerations in terms of social sustainability, impact on the offer and the territory, and protection of natural heritage and scenery. In normal times, and even more so in this phase, the implementation of any strategy thus requires the implementation of adequate policy actions that, by establishing the confines of the actions of individuals, but at the same time encouraging cooperation between different players, favor the birth of synergies between the main actors in the territory.

We are not referring only to environmental indications (certifications of facilities, blue flags, etc.), but also to initiatives such as the G20 (Network of seaside destinations with at least one million tourist arrivals, but with a limited number of residents, on average less than 15,000, but with peaks in the summer months of 6 million arrivals in just a few months), that seek to jointly address the challenges in the sector especially in terms of sustainability, deriving from the maturity of the “sea, sun and beach” product, from the impact on local territories of large numbers of tourists and the effects of climate change. In other words, they seek to address the solution of joint problems linked to both new needs for public services on the part of local authorities, such as services and logistics, and investments in the ecosystem, from the management of local areas to the protection of the coasts and so on. Naturally, in addition to safety, mobility, and the environment, it is important to guarantee better quality of life for residents. Likewise, it will be necessary to incentivize and promote actions by private owners for upgrading of real estate used as vacation homes, that in many Italian locales represent the main type of dwelling.

Therefore, it is increasingly necessary to consider a constant and continuous protection and promotion of both natural and humanly shaped coastal areas, the principal attraction of sea destinations, and the primary reason for tourist stays, but at the same time the central elements in tourist satisfaction – as indicated above – in terms of quality of accommodation facilities. These are both factors that, despite distinguishing between different categories of service, allow for a distinctive positioning and level of the destination, and to attract flows with greater spending capacity; or, also, to favor choices with a specific theme (biking, family vacations, etc.).

It is also necessary to develop greater accessibility with respect to the current and potential source markets of demand, especially with reference to destinations in the Center South and the Islands, that requires not only modernization of infrastructure, but also new agreements with operators, starting with carriers; and, finally, a diversification of tourist products and recreational experiences offered at the destination (also with a view towards quality), so as to better respond to the new needs of demand, to attract and satisfy an increasingly large public and to even further lengthen average stays and seasons. This also through the support for a new widespread spirit of enterprise in local territories, that passes through youth, women, start-ups and microenterprises.

“Performance on European Tourism Before, During and Beyond the Covid-19 Pandemic”, European Travel Commission, 2022.

When we speak of tourism in coastal areas in Europe, it is necessary to distinguish between so-called “sun and beach” vacations, typical of Italy, Spain, and Greece, and “coast and sea” vacations. There are in fact various countries, such as the Baltics, where it is possible to practice sports and experiences linked to the sea, such as sailing or fishing, that are not associated with relaxing on the beach.

“Regional Impacts of the Covid-19 Crisis on the Tourist Sector”, European Commission, 2021.

“Demanio e stabilimenti balneari”, FIPE-Confcommercio, February 17, 2022.

“Viaggi e vacanze in Italia e all’estero”, ISTAT, 2022.

ENIT, 2022.

ENIT, 2022.

“Panorama turismo mare Italia 2021”, JFC, 2021.

“Esodo: 20,8 mln di italiani in vacanza ad agosto”, Coldiretti/Istituto Ixè, July 31, 2021.

“Rapporto sulla ristorazione 2021”, FIPE-Confcommercio, 2022.

OTA saturation means the ratio between the overall supply available and that sold by the principal online travel agencies for a given period.

ENIT, 2022

“Panorama turismo mare Italia 2021”, op. cit.

Ibid.

“Smarter, Kinder, Safer: Booking.com Reveals its Predictions for the Future of Travel”, Booking.com, 2020.

“Rebuilding Tourism for the Future: Covid-19 Policy Response and Recovery”, OECD, 2020; “Understanding Sustaninable Living Through Product Claims”, Euromonitor International, 2021.

“Trending in Travel. Emerging Consumer Trends in Travel & Tourism in 2021 and Beyond”, WTTC, 2021.

“Traveler Value Index”, Expedia Group, 2021.

ENIT, 2022.