E&M

2021/4

Banks and Human Resources: Rethinking the Relationship

Technological progress, cultural growth, and the diversification of customer needs are modifying the business models of banks, their organizational structures, and the modes of production and distribution of products and services, imposing changes in the quality of the human resources employed.#The dilemma that the banking sector must face today in the process of digitalization is how to maintain the proper balance between automation and human contact. The Covid-19 pandemic has put the accent on customer management, that increasingly requires being assisted directly by bank personnel, an element which can also be found among the young segments of the population.#Human resources departments in the banking sector have the task of: sponsoring change management programs, upskilling and reskilling, and reviewing the modes of managing goals and performance in a smart working context. It is no coincidence that in the most innovative and evolved banks, human resources functions have in some cases taken the name of HR Transformation Department.

The evolution of banking activity has never been so rapid and intense as in the last twenty years. Concentrations, technology, competition, legislation, crisis, restructuring, and lastly, the pandemic, have radically changed the world of banking.

The consequences of all of this have been, on the one hand, the separation of banks into two large categories: those that have survived, and those that have exited the market. On the other hand, it has become increasingly pressing, for those banks that have survived, to reflect on their business models, and to adjust them to the characteristics imposed by the changed environment in which they operate and in which they will have to operate in a relatively near future.

Many things have already changed and many others will still change. Among them, what more than others is the object and subject of those changes is represented by human resources. Especially in recent years, the quantitative and qualitative aspects of banks' human resources have evolved intensely and at an increasing speed. The phenomenon has been and will continue to be conditioned by various elements, among which technology has taken on an increasingly important role. The rapid and strong progress of technology, together with cultural growth and the greater sophistication of customer needs, has gradually modified the business model of banks, their organizational structures, and the modes of production and distribution of products and services, imposing substantial changes in the quantity and quality of human resources employed. In particular, that quality has turned out to be decisive for the success of banks in the adoption of new business models and the consequent organizational structures, required by not only technology, but also the evolution of the structure and functioning of the market.

Below we will analyze the evolution of the role of human resources in Italian banks, conducting a comparison with some other countries, and we will outline the main challenges for the future management of the most precious factor of production banks have to carry out their activities: personnel.

A comparison between countries

The growth of the process of digitalization of banking activities is due to multiple concurrent factors. Among those, an important role can be attributed to:

- the development of technology, both in terms of extension and quality of the infrastructure and opportunity for connection and in terms of applications;

- the evolution of customer attitudes and the growing propensity, not only among Millennials, but also among middle and medium or high age customers, to convert towards the use of virtual channels;

- the continuous pressure on banks' financial accounts, that for time has driven the search for greater economies on the cost side through greater implementation of digitalization of production, back office, and distribution processes;

- the Covid-19 pandemic, that has caused a decided acceleration of that process, with the goal of preserving continuity of operations for the banks during the lockdown periods, at the same time protecting the health of their employees and customers.

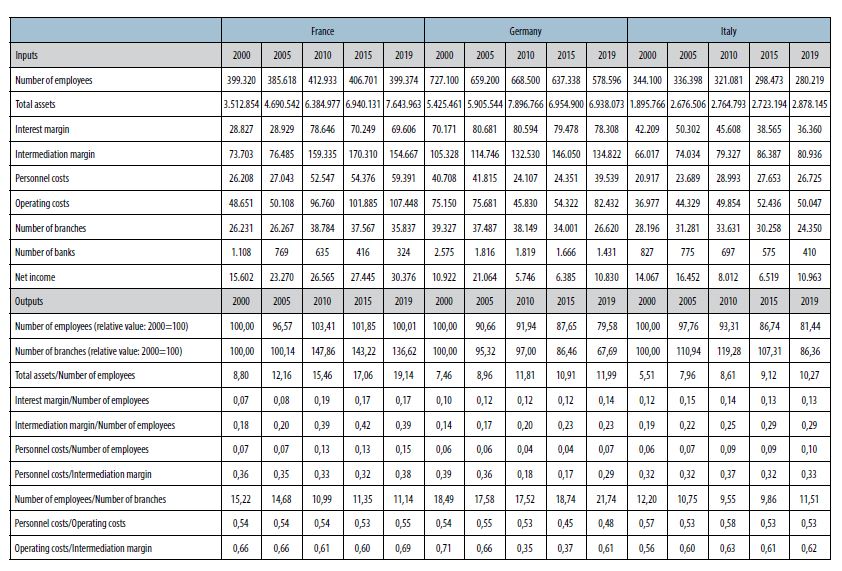

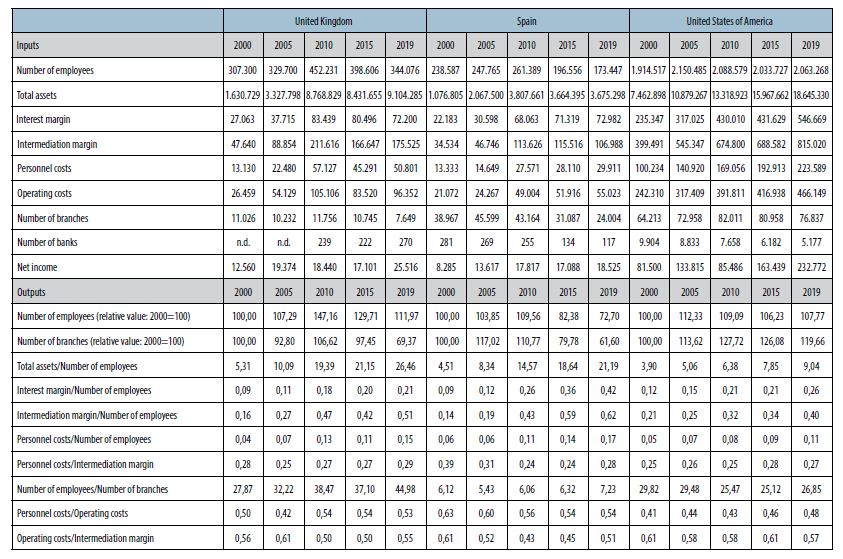

Table 1 presents some of the financial statement data referring to the entire Italian banking system starting in 2000, showing a comparison with the corresponding data for the French, German, British, Spanish, and US banking systems.

This data shows that:

- the number of human resources employed in banks in Italy went from 344,100 people in 2000 to 280,219 twenty years later, a reduction of 18.56 percent. Over the same time span, in France the number was essentially stable, in the United States it increased by 7.7 percent, and in the United Kingdom it grew by approximately 12 percent. In Germany and Spain, the number of bank personnel followed a very similar trend to that in Italy, with a reduction, respectively, of 20 and 27.5 percent;

- the number of bank branches in Italy went from 28,196 in 2000 to 24,350 at the end of the period, with a reduction of 13.64 percent, the result of a strong process of rationalization of the distribution structure. In the same period, branches in France increased by 36 percent, in the United States by 20 percent, and the United Kingdom by 12 percent. Conversely, the number of branches in Germany, in the same period, saw a reduction of approximately 32 percent, and in Spain of 38.4 percent. The strong contrasts in this data are explained in part by the starting point of the analysis and the different degrees of development of branches on that date; for example, if in Italy we were to compare the trend of bank branches starting in 2010 (in which they reached the maximum number) to the end of the period in question, the reduction would be 27.6 percent;

- the number of human resources per bank branch in Italy, at the end of the period considered, was 11.51. While this figure is very close to the French (11.14) and Spanish (7.23) banking systems, it diverges considerably from German (21.71), United States (26.85), and British (44.98) banks;

- the total assets per employee in the Italian banking system almost doubled in the twenty years examined, going from 5.51 to 10.27. At the end of the period considered, only the United States had a lower value (9.04);

- pro capita costs for personnel in Italian banks, along with German banks, show the lowest value in the systems considered;

- overall, personnel costs in the Italian banking system represented 57 percent of operating costs in 2000, and 32 percent of intermediation margin, while at the end of the period they represented 53 percent and 33 percent, respectively, values that are fairly similar to those of the other systems considered;

- lastly, the cost-income ratio of the universe of Italian banks, equal to the ratio between operating costs and intermediation margin, was equal to 56 percent in 2000, compared to 62 percent at the end of the period. Of the other banking systems considered, only the French had a higher level.

The reduction of human resources costs in Italian banks has thus at least partially already taken place, due to the reduction of the number of personnel, due principally to the numerous merger and incorporation processes that took place in the period and the closing of many branches.

Table 1 – Some structural data on the banking systems of six countries

N.B.: Absolute values expressed in local currency/100,000

Sources: Elaboration of OECD data, "Bank Profitability," 2000-2005; ECB, "Statistical Data Warehouse," 2010-2019; FDIC, "Data Tools,"" only US banks, 2000-2019.

Most of the cost-income reduction in Italian banks was in fact due to cutbacks in the cost of human resources, whose productivity – other conditions being equal – thus increased. This increase was also facilitated by the changes that took place in the meantime in the quality of these resources, essentially due to important training actions and absorption of the new culture imposed by the variation of the business model and organization of production and distribution, especially under the influence of technological innovation. These changes were also made possible by the change in the professional mix of the human resources used, achieved above all with continuous hiring of new people, despite the presence of simultaneous exit of individuals with different characteristics, ensuring recruitment and entry into production, distribution, and administration of youth with training more in line with the changed needs of banking activities.

Bank branches and human resources

In all countries, although to different extents, the physical networks of bank branches are contracting due to both the reduction of the demand for financial services and the growth in the use of traditional banking services through digital channels. In response to these needs, banks have abandoned the distribution model based almost exclusively on the use of a single channel, that was largely undifferentiated and multifunctional, adopting differentiated distribution models as a function of the segments of demand served and the products offered.

Yet it is not only demand factors that are leading to less utilization of physical networks, but supply factors as well: the large majority of medium and large-sized banks believe that the dimension of the networks is no longer economically justifiable, and indicates excess production capacity. The introduction of more modern distribution channels allows for containing costs, increasing the quality of payment instruments, with effects that drive the development of the monetary function, and increase customer satisfaction and retention. For years now, banks have offered clients an increasingly broad range of contact channels; from phone banking the 1990s to internet banking and mobile banking in more recent years, and they have increasingly enriched the offer of products and services on each channel. In this context, the branch has become one of the pivots of the distribution model, where the distinctive factor is customer experience, understood as the overall experience the clients have during their relationship with a company through all possible points of contact.[1]

However, numerous studies at the international level show that the branch is the channel associated with the highest level of customer satisfaction, and this does not happen only for the older generation, but also for the intermediate age, and contrary to expectations, for younger segments as well.

The right balance between automation and human contact

In the current context, there is ample room for increased digitalization of the offer of banking services, but at the same time, the bank cannot ignore the fact that its customers perceive digital channels as a source of preliminary information or basic services, but not as a true substitute for the physical network of branches.

The value added perceived by the customer in the relationship with the branch personnel is in fact not considered replaceable by alternative channels based on a virtual relationship. Branches are also attributed the task of transmitting a sense of local "presence," strengthening recognition and trust of the brand. Moreover, the network of branches is still the channel preferred by customers for products and services for which interaction with bank personnel remains fundamental.

The dilemma that the banking sector must face today in the process of digitalization is to maintain the proper balance between automation and human contact. The pandemic has placed an emphasis on this problem: management of the customer, who is scared by the present and uncertain regarding the future, has required a strongly interactive approach. To do this, it is indispensable not to lose human contact: especially in key moments, customers must be assisted directly by bank personnel, guaranteeing that attention and security that only physical interaction can provide. This is the problem towards which the banking system has oriented its main efforts for improvement during the management of the health emergency. In that context, for banks it was decisive to implement a multichannel strategy that reduced the distances, preserving the quality of the relationship.

From this standpoint, it is essential for banks to be able to properly manage the remote channels for contact with customers: implementation of advisory activity, greater assistance through social media channels, efficiency in management of remote channels, and enrichment of online services available.

In that context, banks must increasingly rely on:

- the greater integration among the different channels from the standpoint of so-called omnichannel banking. The new scheme of the relationship between the customer and the bank indicates the customer's expectation to always be able to contact the bank based on their needs and using the easiest and closest channel, combining the different channels at will based on their particular needs;

- the capacity to prepare custom services. The key variable, from this standpoint, is the bank's ability to offer the right product or service to the customer through the appropriate channel, learning to interpret the information gathered and already available, potentially integrating it with other information;

- the increase of points of contact. From this standpoint, all contact channels become important for the development of the relationship with the customer, and it is the customer who determines the mode of interacting with the bank.[2]

The concept of omnichannel banking therefore represents the completion of the prior mode of multichannel banking, but is distinguished due to the integration of the various channels, no longer seen as separate or even conflicting, but as integrated advantageously. The future could even include overcoming the very concept of distinction between the different channels, since artificial intelligence could be given the task of suggesting the optimal channel to the customer (intelligent routing), independent of the point of contact used as the first choice, based on both the type of need posed by the customer and their profile, reconstructed through a big data-type analysis.

Redesigning the employee experience

For all companies, and for banks in particular, the quality of the service offered comes first of all from good interaction between personnel and customers: the customer experience offered by the bank, in fact, has been closely correlated with the employee experience, understood as the sum of the psycho-cognitive feelings produced daily by the interaction between workers and the company organization.

Customer satisfaction derives precisely from the positive experience of personnel, from their satisfaction in performing their work, that translates into greater orientation to the customer's needs. To provide a high-quality service, motivated people are needed, who wish to actively satisfy customers' needs and do not only feel forced to do so.[3]

Human resources must be competent and transmit the bank's values to customers through their behavior, proper communication, and the constant evaluation of feedback from customers.

The traditional model of business communications based on a top-down approach offers few opportunities for interaction between the youngest employees and top management. It is therefore necessary to favor the launch of new channels for information exchange, based on an open communication between the different functions, through tools that allow the persons involved to express their own opinions, propose new ideas, share the feedback received from customers, and their own experiences of interaction with customers.

The internal organization model that is prevalent today, which is pyramid-like, compartmentalized, and largely inherited from the military world and Taylorism, tends to relieve human resources of responsibility. The adoption of a nimble spirit – like that necessary for an innovative bank oriented towards digital – implies, on the other hand, the mobilization of the strength and intelligence of all associates. In this context, the bank management should be based on the "why" and not the "how," and should produce associates who are given responsibility and an organization consisting of small autonomous groups, divided by business line, with a reduction of hierarchical intermediation.

Today, banks still have much to do to incorporate the concept of employee experience within their culture. This is a fundamental step to guarantee a competitive advantage that is sustainable in the long-term.

From remote working to smart working

Smart working exploded during the pandemic, but in the Italian banking sector it had already been used for some years, although to a very limited extent, with the goal of increasing the personal and professional well-being of workers. Other goals pursued with the launch of smart working regarded the desire to increase the bank's organizational flexibility, to attract new talent that did not intend to work in a bank in a traditional way, and to achieve a more efficient and sustainable use of the available resources.

With only the exclusion of companies that had already experimented with smart working, the sudden and generalized remotization of work imposed by the health emergency ended up replicating at home the same organizational rigidness that was typical when working in the office. So there is a lot of work to do on the organizational culture of smart working, that is differentiated from simple remote working. Smart working implies autonomy for workers, but also fostering responsibility on the times and modes of execution. Only in cases where the company fabric was more prepared did the banks intensify its use, consolidating the instrument. In other situations, once the effect of the lockdown passed, there was mostly a return to physical presence in the workplace.

The judgments of the experience of this forced remote work were generally favorable, even though there were some negative observations from workers, some of whom complained of the unpreparedness of managers to manage this new experience, their own limited digital skills, the difficulty of maintaining balance between work life and private life, and the sensation of isolation and nostalgia for the office.

As has been clearly demonstrated by a recent study of the Smart Working Observatory of the Milan Polytechnic University, smart working not only helped many companies ensure the continuity of their activities, but also highlighted the obsolescence of work models that have not changed for years, in which goal-based work, the role of digital, and the importance of a new relationship between work life and family life have been inserted.[4] The same study then acknowledges the positive results of the experience gained during 2020 under the thrust of the pandemic, and finds that it is extremely precious to design and experiment with new ways of working, that will constitute a fundamental instrument of competitive advantage once a condition is reached in which it will finally be possible to choose between smart working and physical presence based on needs and preferences. Then it will be possible to realize the true goal of smart working: give people the autonomy to define where, when, and with what tools to perform each activity, provided that this produces better results for the organization, the people, and society.

In a nutshell, the future of smart working, in the broader context of bank strategies and functioning, can be assumed recalling the need to rethink the management of banks according to a profound reassessment of models, with new paradigms of organization of work, paths of cooperation and trust that cut across sectors, and can be measured through planning and operations based on goals. Ultimately, it is not a question of creating a generation of smart workers, or giving up on office or branch work, that will remain the focal point of relationships for a long time, but of redesigning the processes and modes of pursuing the targets. In the new post-pandemic normal, banks, like other businesses, must promote a culture based on responsibility and trust, that exploits people's potential and favors the spread of a mindset oriented towards reaching results.

The extensive adoption of a new mode of work, based also on a combination of work from home and work in the office, also offers the opportunity for a transition towards a more environmentally sustainable model, and in particular, it allows people to better reconcile work life and personal life and have access to more professional opportunities, also for talented individuals who do not live near office parks, with unquestionable advantages for levels of motivation and productivity.

A new way of organizing work can lead to greater efficiency in the overall use of the resources available to banks, but also real estate assets and resources used for trips and travel.

The new functions of the HR department

The Covid-19 emergency seems to have definitively anointed the human resources department as one of the strategic functions for the future development of business, including in the banking area.

The human resources function has the challenge of guiding people in a moment characterized by strong transformations in the way of working and managing interactions with colleagues and customers, seeking to maintain high levels of connection, engagement, and productivity.

It is precisely in the evolution of remote working to smart working that the human resources function can play a key role; for example, promoting structured programs of change management, designing upskilling and reskilling processes to face the need for new skills, and critically reviewing the ways of managing objectives and performance in a smart working context. It is no coincidence that in the most innovative and evolved banks the human resources function has in some cases taken on the name of HR Transformation Department.[5]

The position of the managers more directly involved in the governance of human resources has also changed, and the role of that governance is fully evolving. Some questions that kept personnel departments busy until just a few years ago are in fact losing importance; think of selection, careers, training, evaluation, aspects linked to remuneration, outplacement, and so on. Conversely, other issues are taking a predominant role in the work of human resources department, such as welfare, active aging, smart working itself, diversity and equal opportunity, ecological and environmental sustainability, artificial intelligence and big data, corporate governance and the relationship with all other stakeholders.

For this reason, the placement of what was previously the personnel department in the bank's organization chart is changing with respect to the past, and the skills of the respective directors are not only the specialist skills from before, but much more similar to those of a managing director, with the addition of strong technological knowledge. Human resources and their management are thus becoming one of the most important centers of development of banks' business models, and could condition their success, involving all aspects of continuous change in banking activities together.[6]

The future of work and banks

For the Italian banking system, the period from 2000 to 2020 was characterized by significant transformations, that led to the development of plans for optimization of organizations, simplification of branch networks, rationalization of resources, and the gradual shift towards digital channels. This was a revolution that led to a change in the balance between the different channels for contact with customers, with the rise of remote channels and the reduction of direct interaction in branches. Thanks in part to these strategic and organizational choices, the Italian banking system has been able to overcome an extremely complex period, characterized by very low or negative interest rates, that created a profitability crisis.

Now it is time to bring people back to the center of banks as a strategic asset to manage the relationship with customers. This is also true in light of the profound disruption caused by the Covid-19 pandemic. Thinking of the future, it is thus likely that the following statements apply to banks as well: "The place where things are made will increasingly be less important, while there will be more and more places with interconnected workers who manufacture the future. Work will be performed everywhere and nowhere, always and never, with the awareness that work will be part of life and life will also be work, that will finally be pleasant… this is the only way for motivation to be high, minds free and demanding. Organizations first of all will not be the same, work will no longer be the same. On the other hand, the organization of work as we know it today is more or less two hundred years old; before that it was different, and in the future it will be different. People have different expectations, motivations, and consider work itself in different ways."[7]

Synopsis

- Technological progress, cultural growth, and the diversification of customer needs are modifying the business models of banks, their organizational structures, and the modes of production and distribution of products and services, imposing changes in the quality of the human resources employed.

- The dilemma that the banking sector must face today in the process of digitalization is how to maintain the proper balance between automation and human contact. The Covid-19 pandemic has put the accent on customer management, that increasingly requires being assisted directly by bank personnel, an element which can also be found among the young segments of the population.

- Human resources departments in the banking sector have the task of: sponsoring change management programs, upskilling and reskilling, and reviewing the modes of managing goals and performance in a smart working context. It is no coincidence that in the most innovative and evolved banks, human resources functions have in some cases taken the name of HR Transformation Department.

E. Minelli (edited by), Banca skill. Persone e tecnologie nella banca del futuro, Guerini Next, Milan, 2021.

R. Ruozi, P. Ferrari, G. Abate, "Lo sportello bancario del futuro," Bancaria, 5, 2020.

M. Magnani, Fatti non foste a viver come robot, Utet, Milan, 2020.

"Lo smart working ai tempi del Covid-19: come cambia il lavoro dopo l’emergenza," Smart Working Observatory – Milan Polytechnic, 2020.

"Oltre l’emergenza COVID nelle banche," Exton Consulting, May 7, 2020.

"La gestione delle risorse umane nell’era Covid-19: investire sulle persone," KPMG, March 3, 2021.

I. Covili Faggioli, "Il futuro della direzione del personale," in U. Frigelli (edited by), HR. Le nuove frontiere, FrancoAngeli, Milano, 2020, p. 11.