E&M

2022/1

The Strength of the Example of the Italian Manufacturing System

During the course of 2020-2021, the Italian production system, thanks to the dynamism of single businesses or through the creation of networks, proved to be resilient and able to rapidly recover from the drops in production suffered in the initial period of the pandemic. In the months of the lockdown, various businesses launched new product lines (personal protective equipment, medical devices, air purifiers, and non-health products and services for which demand exploded during the Covid-19 emergency), that were then integrated into production processes. The businesses that have done better than others in mitigating the effects of the crisis and launching actions for recovery, have acted following three principal phases: a reaction to the pandemic, aimed at addressing the emergency and guaranteeing security and revival of their business; resilience and recovery, based on operational agility and the ability to select and guarantee the continuity of business; and a redesign phase, to draw value from the lessons learned and rethink new business opportunities.

The pandemic crisis has hit the Italian economy and industry hard. According to the 2021 report on the competitiveness of Italian production sectors,[1] the measures taken to stem the pandemic produced a global macroeconomic shock in terms of both the closing of activities, and the slowdown of the demand for goods and services. Global trade, including Italy's share, saw a drop between March and April 2020 to then grow vigorously starting at the end of 2020, and continue through 2021. In terms of volume, GDP fell by 8.9 percent, to then bounce back by 6 percent in the estimates for the end of 2021, and over 4 percent is forecast in 2022.

After China, our country was the first to be overwhelmed by the health crisis, which rapidly transformed into an economic crisis with implications and after-effects that will persist and produce effects also from a social standpoint. During the initial phase of the health emergency, many businesses, both large and small, well-known or not, responded to the requests from the government or acted based on their own sense of values and social responsibility, to launch production of protective equipment and at times complex components for respirators and masks for pulmonary ventilation.

The response of the Italian production system to Covid-19

These included, to cite some cases reported by the press:[2] Bulgari, the famous luxury brand owned by the LVMH Group, that transformed some lines of perfume production to manufacture 6,000 bottles of disinfectant liquid a day; 180 other businesses in the fashion sector, including brands such as Fendi, Armani, Ferragamo, Celine, Valentino, and Serapian Richemont, that worked to produce 2 million surgical masks; Prada, that began production of 80,000 gowns and 110,000 surgical masks for the health system of Tuscany; Gucci, that planned the production of 1.1 million masks and 55,000 gowns for the same region; and Giorgio Armani, that initiated the reconversion of its plants to produce disposable gowns. In addition, alcoholic drink businesses began the production of disinfectant alcohol and other businesses launched production of Plexiglas barriers, anti-infection protective screens, thermo-scanners, and sanitizing materials.

There are well-known cases such as Lamborghini that produced pulmonary simulators used in the testing of machines before final inspection, and many more. An exemplary case is that of Ferrari (see "The case of Ferrari") that collaborated with a network of partners, including the Italian Institute of Technologies, and some manufacturers for the production of a pulmonary ventilator, designed in just a few weeks. Moreover, Ferrari used its design skills and 3D printers for the production of valves for respirators, thanks also to the collaboration of giants in the production and distribution of sports articles, who did not hesitate to donate thousands of snorkeling masks to be reconverted into oxygen masks. The common denominator of the Ferrari projects, in addition to the orchestration of a network of partners with strongly-rooted knowledge in the field, was thus the possibility for rapid and open sharing of all of the information and data necessary for rapid success. This model has been studied and named "social manufacturing."[3]

The case of Ferrari

During the early months of the pandemic, the famous sports car brand from Maranello managed some important projects on the emotional tide of what was happening. An initial project led Ferrari to share its design know-how, as well as its supplier network, in order to rapidly produce valves for pulmonary ventilator masks. Ferrrari immediately shared its knowledge regarding materials for the valves such as ABS, as well as knowledge of prototyping and the use of 3D printers. One of the winning aspects of the project was the orchestration of a network of partners having strong skills in complementary areas, such as Solid Energy, a builder specialized in 3D printers; Nuovamacut, which offered its services as a logistical hub for distribution; and Decathlon and Mares, involved due to their technical knowledge of masks, while a specific partner dealt with the parts relating to approvals and legal compliance of the product in the category of medical devices.

The Ferrari team achieved the validated prototype, called Job One, in just 24 hours, and in the subsequent three days consolidated the entire process of production and distribution to hospitals. The business went from an initial production of 26 valves per day to 600-700, also using the production capacity of the team dedicated to Formula 1 racing. This team also participated in the design and production of a new system for pulmonary ventilation in just five weeks, with the peculiarity of costing less, being more easy to assemble, more reliable, and consuming less oxygen, a gas that was very hard to procure at the peak of the pandemic.

A second case reported by the press is that of Isinnova (see "The case of Isinnova"), an innovative start-up that collaborated with the Hospital of Chiari at the high point of the emergency, designing and coordinating the production of valves for respirators, through the activation of a circuit of microenterprises and makers with specific skills in 3D printing. While Ferrari was able to base its work on a network of well-structured medium and large enterprises, the case of Isinnova, on the other hand, demonstrates how certain skills and abilities can be acquired by small and medium enterprises, and even by individuals. These partners are often identified in the literature as "makers": in essence it involved FabLab digital laboratories with one or just a few 3D printers that participated in the social manufacturing networks up to the limit of their resources.[4]

The case of Isinnova

A business that is small, but strongly devoted to innovation such as Isinnova, orchestrated an effective network of makers during the early months of the pandemic. Thanks to the intuition of an anesthetist who noted the similarities between ventilator masks and the snorkeling masks made by Decathlon, the business began production through 3D printing of the valve, an essential element of the mask. Dubbed Charlotte and now patented, as in the case of Ferrari the valve was conceived, tested, and validated directly in the field in a single day. To that end, Decathlon, the well-known sporting goods chain, acted as Ferrari had and immediately made available all of the technical data of the Easybreath snorkeling mask, as did Isinnova for the valve. At this point, in order to increase production capacity, various other makers stepped in. Through the use of the web and social networks such as LinkedIn, Isinnova, with the assistance of partners such as Kilometro Rosso, a hub of businesses dedicated to innovation, requested help from all the businesses able to replicate those valves through 3D technology. Isinnova made the technical data in its possession available in open form, and in just a few days 2,700 makers from Italy, Europe, and even Canada began to produce the valves, each within the limits of their own capacity. To complete the product, Decathlon ultimately donated 10,000 Easybreath snorkeling masks. In just a few weeks, thousands of masks and valves were delivered to Italian hospitals, and subsequently, the masks were also used in Brazil, Indonesia, Morocco, the United States, Uzbekistan, and other countries around the world.

However, most of the businesses belonging to the Isinnova network offered their skills and production capacity, which at that time were not being used due to the stoppage imposed by the lockdown, for a limited period of time, based on the value-based and emotional impulse dictated by the moment of health crisis, in particular in the hardest hit areas of the country. In many cases, these actions were "purpose-led,"[5] i.e. driven by a spontaneous and generous reaction often motivated by the desire to give back value and support the local communities and territories in which the production plants are located. In some cases, though, this occasional effort was transformed into an opportunity to be promoted and pursued, with the goal of building on the experience gained in assisting the institutions and local areas and attempting to cultivate new business opportunities, whether to saturate production capacity taxed by the global pandemic, or to guarantee stability of employment, or also to attempt to enter into new markets.

The manufacturing sector in Bergamo

Numerous businesses exploited the flexibility of their internal processes to remain operational even during the lockdown period of 2020. To explore this phenomenon and understand its underlying motivations and enabling conditions, a survey is being carried out involving the industrial businesses active in the territory of the province of Bergamo. Thanks to the support of Confindustria Bergamo, an initial set of data has been collected, that allows for outlining the preliminary results relating to the goals of this study.

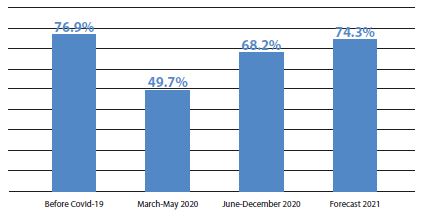

Figure 1 – Degree of saturation of production lines

As can be seen in Figure 1, the degree of saturation of production lines, that in the sample businesses was 76.9 percent on average prior to Covid-19, suffered from a significant slowdown during the lockdown in the period March-April-May 2020, touching 49.7 percent. However, in the period immediately after that, i.e. the second half of 2020, a recovery began to emerge that brought this indicator to 68.2 percent, to then reach 74.3 percent in 2021 (forecast). Overall, those values provide a picture of a resilient production system, able to rapidly make up for the temporary drops in production suffered in the initial period of the pandemic. The available data also shows that a subset of businesses in the sample, equal to slightly less than half, launched new product lines during the lockdown (March-May 2020) to offer a response to the specific needs that emerged during that period, regarding personal protective systems, medical devices, and new products and services in non-health areas for which demand exploded during the Covid-19 emergency, such as air purifiers or artificial intelligence situations useful to address specific caused provoked by the pandemic. The businesses that were able to launch these new production activities were also asked if, once the pandemic emergency is over, they intend to continue to produce the articles and services recently introduced on the market. On a scale from 1 (absolutely disagree) to 5 (absolutely agree), the average was equal to 3.8. This seems to demonstrate that the businesses in question not only were able to respond to a moment of deadlock on their traditional markets by launching new products and services, but also that this experience seemed useful to learn how to tactically saturate their production lines with operations that, despite not constituting their core business, made it possible to support their overall profitability.

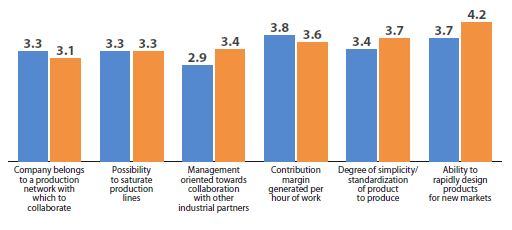

As regards the motivations driving the decision to launch a new product, the analysis of the data shown in Figure 2 is interesting, as it provides a comparison between the average evaluations obtained from the businesses in the sample that launched new production lines with those, on the other hand, that did not change their offering (expressed on a scale from 1 to 5).

Figure 2 – Significant motivations in the decision to launch a new product

In this regard, it seems significant that, for businesses that launched new production lines, the most important motivation regarded the speed of developing new products (average evaluation: 4.2), followed by the degree of simplicity/standardization of the product (average evaluation: 3.7). These two aspects, considered together, appear to indicate that this subset of businesses have greater awareness of a process of product innovation that, at a time such as that of the Covid-19 pandemic and the related lockdown, required considerably prompt action, guaranteed among other things by the simplicity of the product to be developed. To the contrary, the businesses that did not launch new articles showed that they consider the most important motivation for the development of a new product to be the contribution margin it is able to generate per hour of work (average evaluation: 3.8).

Although the limited number of businesses involved in the study to this point does not currently allow for verifying the statistical significance of the comparison between these averages, the data now available begins to provide an outline of the two types of businesses with different cultures and levels of production skills, that impact the ability to respond to market turbulence and the general economic context.

Phases and exemplary cases

Observing the actions taken by the businesses that were most able to mitigate the effects of the crisis and launch recovery interventions, it is possible to identify some principal phases:

- the reaction phase;

- the resilience and restarting phase;

- the redesign phase.

The immediate reaction phase, aimed at facing the emergency, guaranteeing security, and reviving the business through the creation of crisis teams and the first action protocols, the revision of operating models to guarantee safety for the personnel, training and investments to facilitate distance working, transparent communication to stakeholders and constant monitoring of liquidity and cashflow dynamics through constant monitoring of time to recovery and time to cash (on this point, see "The case of Agrati").

The case of Agrati

Seventh in the world in its sector, present on three continents with a production of approximately 8 billion pieces per year, Agrati operates with its 12 production facilities, 5 logistics centers, and 2,400 employees in the world of fastening solutions and automotive components. At the beginning of January 2020, due to the Group's presence in China, the company recognized the alarming signs of the pandemic underway. A crisis task force was immediately organized at the headquarters, comprised of 10 people, with the goal of monitoring the evolution of the pandemic situation in countries where the company has a presence, defining priorities, ensuring close coordination with local units, strengthening communication and alignment of the initiatives to be implemented, and developing a process of scenario planning.

The crisis task force rapidly developed a plan organized into five clusters of attention: people, operations, clients, suppliers, and cash flow, defining the following priorities: 1) to guarantee the health and safety of its people, identifying possible vulnerabilities: 2) to launch a process of rmap-down and closure of its facilities located in vulnerable areas; 3) to activate measures able to ensure short-term liquidity, maximizing local opportunities with respect to cash pooling initiatives; 4) to ensure support and financing from the governments of countries where the Group is present; and 5) to prepare an efficient post-crisis restart with the goal of emerging stronger through an improvement of its performance and capitalizing on all emerging strategic opportunities.

Agrati got through 2020 brilliantly due in part to the recovery of the market in the second half of the year, especially in the last quarter, succeeding in closing the year with a positive financial result despite a 20 percent drop in volume. However, 2021 turned out to be a year that was just as hard, and perhaps even more challenging than 2020, with very weak volumes, to which were added various elements of volatility and uncertainty linked to the prices of raw materials and other factors of production such as transport, energy, and components.

The phase of resilience and restarting, based on operational agility and the ability to select and guarantee continuity of business, was implemented thanks to the ability to focus priorities (selection of channels, products, markets, etc.), allocate investments based on business priorities, balance the trade-off between the need for redundancy (stock, new suppliers, etc.) and liquidity, and to plan production based on the actual sell-out of the channel (in this regard, see "The case of the Arstana Group").

The case of the Arstana Group

Arstana is a Group with 1.7 billion in turnover, that having between 50 and 90 percent of its supplies coming from China, found itself subject to a stoppage in January 2020 in that country, and then, as a consequence of the various lockdowns implemented in European countries and in the Americas, also a stoppage in its end markets.

The Group thus launched a project aimed at the maximum resilience, going from a lean supply chain to an agile one, organized in two principal phases: a first phase, with a lockdown upstream and downstream, principally aimed at: 1) not losing market share, focusing its deliveries towards practicable channels, such as e-tailers; 2) not losing efficiency in production along the supply chain, rethinking the logic of positioning of product stock; and 3) implementing very strict controls on its own working capital and cash flow. In the short term, it became necessary to adopt a planning approach even more integrated with the Finance and Marketing/Sales sectors, aimed at more clearly defining the classes of priority regarding articles, markets, and channels/clients. This was implemented through careful focalization of which articles to produce, where to produce them, and with significant planning aimed at limiting a potential increase in stock, operating in a make-to-order logic towards clients able to receive deliveries and implementing actions to mitigate risk through initiatives for sharing and compensation of raw materials and products between the various warehouses distributed in the areas served.

A second phase, post-lockdown, that paradoxically was much more complex due to the uncertainty linked to the difficulty of foreseeing the reaction of its clients, had the goal of: 1) increasing sales volumes through targeted promotions, that drove the growth of production volumes; and 2) maintaining strong attention to limiting working capital and overall efficiency. This also accelerated projects for revising the footprint, more substantially reassessing solutions for reshoring/near shoring, with the goal of increasing the resilience and agility of the supply chain.

This second phase was based on a high frequency of forecasting and planning driven by analysis of sell-out in terms of mix and volumes; a reduction of the lead times aimed at a prompt reaction to market stimulus; and the use of tools to simulate alternative scenarios in order to coherently modify the operations of its production network.

The redesign phase had the goal of implementing the lessons learned and rethinking new business opportunities through reshoring and insourcing measures, and redesigning the supply chain from a local for local perspective, promoting the digitalization of processes and accessing new channels (online), to the point of implementing operations of partial industrial reconversion or the launch of new businesses (see "The case of RadiciGroup").

The case of RadiciGroup

With approximately 1 billion euros in turnover and 3,000 employees, RadiciGroup produces and sells intermediate chemical products, technopolymers, and textile solutions through a production and sales network with over 30 sites in the world. The heart of RadiciGroup is located in the province of Bergamo, and in March 2020 the Group responded to the desperate request linked to the health emergency by launching an initiative entitled WeCare, for the production of protective clothing for medical use. In only 12 days, it selected which materials to use, with which partners to interact, and what standards to use; it constructed the supply chain, preparing the materials for the first tests and prototyping phase, obtained the certification, and launched production. Thanks to the experience and know-how accumulated in years of manufacturing, in just two weeks the Group was able to deliver surgical gowns, caps, and shoe coverings to local hospitals, reconverting some production plants and guaranteeing employment for its workers during and after the lockdown period.

From a decision to support the local community during the emergency, the production of personal protective equipment (PPE) was subsequently transformed into a new line offered by the Group, focused on the production of PPE for both medical and industrial purposes. In addition, after making contact with Oerlikon, a global leader in solutions and equipment, in July 2020 RadiciGroup was informed of the availability of a new machine, immediately available due to a cancelled order, and decided to invest 15 million euros in a frontier technology for meltblown production, a fabric with high filtration capacity used for masks. The new plant, delivered in September, was rapidly installed and began production in December 2020, opening up new business opportunities, in synergy with the Group's core activities, especially in terms of applications aimed at the industrial and medical market for filtration of gas and liquids.

Concerted and coordinated action

The summary examination of experiences presented here, among the many that took place in our country and around the world in order to resist the wave of crisis provoked by the pandemic, to ensure the continuity of activities, and where possible, to seek new business opportunities, demonstrate the need for a structured approach of crisis management and prompt restarting of business activities. Those who were able to manage the crisis well demonstrated the ability to:

- prepare organizational solutions, procedures and protocols to identify and promptly address the emergency and any consequent area of discontinuity in management;

- focus their actions and available resources by selecting channels, markets, and products to serve, developing multi-scenario planning systems and timely sales actions guided by information collected on sell-out processes;

- seek continuity in supplies through interventions to redesign supply chains, support strategic suppliers, and monitor of procurement processes;

- ensure financial resources and design measures and control systems relating to key indicators, such as time to cash and time to recovery;

- seize emerging opportunities leveraging design creativity, flexibility of their production organizations, and new spaces on the market opened by the crisis.

There is no doubt that overcoming this crisis, that may be unique in terms of duration, severity, pervasiveness, and global extension, requires support measures at the national and international level. In that sense, it is crucial to recall the set of maneuvers that are part of the broader picture of the National Recovery and Resilience Plan (PNRR), and in particular its missions linked to digitalization, innovation, competitiveness, and culture, but also the green revolution and ecological transition, and education and research, for which close to 150 billion euros are to be allocated.[6] This is a unique opportunity to relaunch and modernize the production system of a country, Italy, that is second in Europe and seventh in the world in terms of its industrial system. The vision is clear and the intent consistent with the country's needs. The hope is that the considerable resources made available can correspond to a concrete ability for execution by the public and private entities identified as the implementers of the programmatic lines of the Plan.

As for all of the crises that the economic-social system has had to face, this one will also select the businesses that have been better at mitigating its effects, and that will be able to recover thanks to a solid financial and managerial basis, drawing on the lessons learned and banking on reconstruction that leverages concreteness and creativity in searching for new business opportunities. The significant impacts that the current crisis has already highlighted and the reflections that will challenge the stability of the social systems of many countries, though, strengthen the conviction that it is necessary to support a rebirth that focuses on people, in which economic recovery is not achieved at the cost of social solidarity, but the former is a means to affirm the latter.

Synopsis

- During the course of 2020-2021, the Italian production system, thanks to the dynamism of single businesses or through the creation of networks, proved to be resilient and able to rapidly recover from the drops in production suffered in the initial period of the pandemic.

- In the months of the lockdown, various businesses launched new product lines (personal protective equipment, medical devices, air purifiers, and non-health products and services for which demand exploded during the Covid-19 emergency), that were then integrated into production processes.

- The businesses that have done better than others in mitigating the effects of the crisis and launching actions for recovery, have acted following three principal phases: a reaction to the pandemic, aimed at addressing the emergency and guaranteeing security and revival of their business; resilience and recovery, based on operational agility and the ability to select and guarantee the continuity of business; and a redesign phase, to draw value from the lessons learned and rethink new business opportunities.

"Coronavirus, da Prada e Gucci a FCA e Ferrari: tutte le aziende italiane che riconvertono la produzione per fare mascherine e ventilatori", Il Fatto Quotidiano, March 26, 2022.

M. Hamalainen, J. Karjalainen, "Social Manufacturing: When the Maker Movement Meets Interfirm Production Networks," Business Horizons, 60(6), 2017, pp. 795-805.

A. Chiarini, A. Grando, V. Belvedere, "Disruptive Social Manufacturing Models: Lessons Learned from Ferrari Cars and Isinnova Networks for a Post-Pandemic Value Creation Path", Production Planning & Control, 2021.

G. Ferrigno, V. Cucino, "Innovating and Transforming During Covid-19: Insights from Italian Firms", R&D Management, 51(4), 2021, pp. 325-338.